In my last quarterly letter[1] I discussed life insurance products—term, whole and universal—and their characteristics. This time, I will take a deeper dive into a strategy that benefits younger people when it comes to insuring their lives.

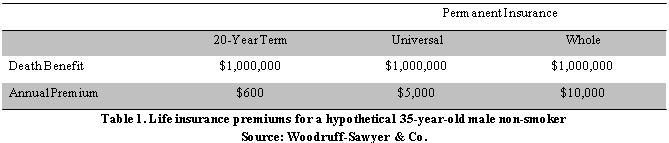

First of all, let us refresh our memory on the cost of various life insurance products (Table 1).

As Table 1 reveals, the steep cost on permanent life insurance (both universal and whole) makes potential buyers think twice, if not completely banish the idea. For most young families, having permanent life insurance is not only expensive but also unnecessary. By the time one reaches the “empty nest” or retirement, the combination of reduced financial obligations (mortgage, loans etc.) and a build-up of assets (hopefully!) means that life insurance needs are no longer as important as they were 20 to 30 years ago.

However, building a nest egg for retirement continues to be a huge struggle for the majority of Americans. A recent study shows that merely about half of the private workforce is participating in a 401(k) plan, of which less than half is contributing 10% or more.[2]

What if there is a way to kill two birds (insuring life and saving for retirement) with one stone? Would you be interested in learning about it? The magical “stone” is called the Roth IRA, and the strategy combines the use of term life insurance and the Roth IRA. You can read all about the Roth IRA in one of my other newsletters.[3] For this discussion, let us keep things simple by assuming that

- You, a 35-year-old male, purchase a 20-year term policy of $1,000,000 with an annual premium of $600.

- You fund your Roth IRA with $5,000 every year for 20 years.

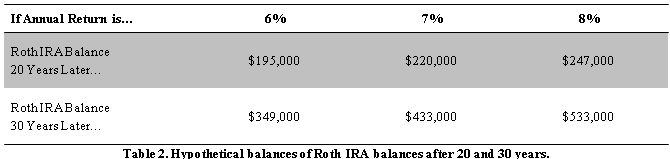

Table 2 summarizes the hypothetical balances under different return scenarios.

Question: Why use the Roth IRA instead of a regular brokerage account?

Answer is simple: Because of Roth IRA’s unique tax-free withdrawal feature.

Just like the case in life insurance payout, which is free of tax, Roth IRA withdrawals, when certain requirements are met, are not subject to taxes either. If scenarios in Table 2 take place in a taxable situation, the after-tax results look like this:

The worst possible case is when using a regular IRA as the savings vehicle. Every dollar is taxable at the ordinary income rate! Another reason to use the Roth IRA is the ability to name and change beneficiaries, also similar to life insurance.

Ideally one should not regard “life insurance” as a means to saving for retirement; insurance only serves one purpose—transferring a particular and unwanted risk to the insurance company. Should you be approached to consider life insurance under the grand theme of retirement savings, there is a simple (and better) alternative! (Note: you should also read Eight Precautions When Using Indexed Universal Life to Save for Retirement by an industry insider.[4])

Happy summer!

[1] Estate Planning 301: Use of Life Insurance. http://bit.ly/1qENOQZ

[2] “More Men than Women Saving at Needed Retirement Rate.” BenefitsPro. http://bit.ly/1spwUK6

[3] Five Reasons to Go Roth. http://bit.ly/1ktQcX7

[4] http://bit.ly/1kwUSLI