Today, many Americans’ retirement dreams are dependent upon two crucial incomes: Social Security benefits and personal savings—in tax-qualified retirement accounts, in personal, taxable formats, or a combination of both. As of 2014, the Social Security OASI Trust Fund had over $2.6 trillion in reserves,1 while aggregate retirement assets approached $25 trillion in first quarter of 2016.2

In the early 80s, almost half of the American workforce in the private sector was covered by defined benefit (DB) or pension plans. Defined contribution (DC) plans, on the contrary, were in the infant stage, thanks to a series of legislations enacted during that era.3

Fast forward 30 years, DC plans such as 401(k)s have grown to become the norm rather than the exception. The result: The American worker nowadays has to take on the responsibilities that were once held by their employers of managing their own retirement affairs. That has led to a brewing crisis in retirement planning, summarized by the Harvard Business Review as follows:4

- Individuals with little or no financial knowledge are now in charge of making complex investment decisions.

- Emphasis has been put on investment performance instead of retirement goals.

One of our roles as your advisor is to educate you so that better financial decisions can be made. There are, indeed, many things that you can do to prepare yourself for retirement, some of which are surprisingly simple. Let us explore them.

Make Retirement Savings a Priority

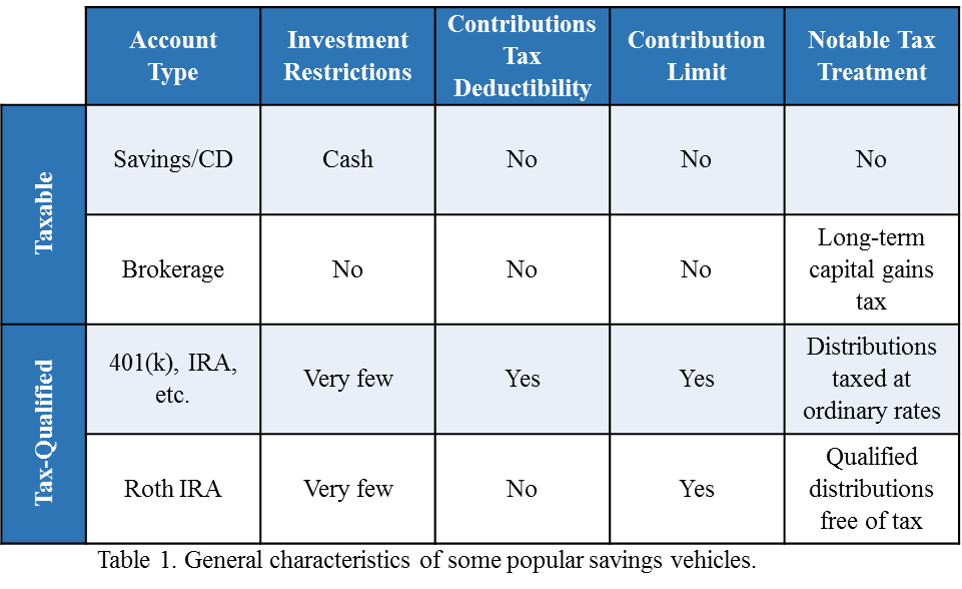

The other day I was showing a budget worksheet to a client, who noticed that “Savings” was the first line item. It is important to understand the significance of saving, not just for retirement’s sake. Some of the common means of saving are summarized in Table 1 on the next page.

How do you discipline yourself to save before spending? In our view, the best practice is to do so in an “auto-pilot” mode. For example, your contributions to a 401(k) plan are automatically deducted from payroll and invested. The funds never come to your hands and they are held in a secure and restricted manner. A similar arrangement can be easily established with other account types too for different purposes, such as an emergency fund, or a down payment for your first home.

Make the Savings Inaccessible

That brings us to the next suggestion: Leave the funds alone as if they did not exist. If you have money in somewhere other than your primary checking account, you will be less tempted to access them whenever you want. Savings accounts and CDs are a good option, so long as you can resist the temptation to withdraw the funds. Brokerage accounts, particularly the ones managed by a bona fide advisor, are a better choice. The advisor serves as a facilitator who helps form good financial habits as well as the “buffer” that separates all the news headlines from what matters to you.

Also, in our experience, clients whose investments have lasted a long time have one similar trait. (Hint: it has nothing to do with their account size.) They provide genuine and rational reasons for their spending, which usually goes towards experience and memories. Some of them even feel guilty about spending their own money!

Take What’s Rightfully Yours

What do I mean by that? Two things, simply. Spend some time on researching benefits provided by your employer. Many companies, for instance, have created retirement plans and offer a match (3% typically), but you have to sign up in order to take advantage of that. If such a plan is not available or you are a small business owner, encourage management to look into the type of plan that is suitable for the business, work with consultants and plan providers who possess expertise in this area.

Automatic enrollment, in which employees automatically participate when they become eligible unless they opt-out, has been gaining popularity in the country. Other favorable features include automatic annual increase on contributions, educational seminars, and retirement planning services. Companies are empowering employees with ways and access to better prepare for their future. They understand that happy employees boost their productivity as well as loyalty.

Envision Your Retirement

Retirement planning is not rocket science; nor do you need to keep working into your 70s or 80s. All it takes is a vision: your retirement lifestyle and how much that would cost. From there we can calculate, based on various assumptions, the so-called “magic” number—the dollar amount on which you could comfortably retire. If it is realistic, we can then figure out a savings plan to help reach the goal and make periodic adjustments. If your retirement dream seems like a long shot, perhaps it needs to be fine-tuned, perhaps it needs to be re-drawn, or perhaps “dream big” is your motivation for having a retirement roadmap that you can stick to.

Whatever your retirement picture looks like, we are with you every step of the way.

Footnotes:

1 https://www.ssa.gov/oact/TRSUM/2014/tr14summary.pdf

2 http://www.benefitspro.com/2015/06/30/total-retirement-assets-near-25-trillion-mark

3 https://www.ebri.org/publications/facts/index.cfm?fa=0398afact