On January 1, 1994, President Bush, Canadian PM Mulroney, and Mexican President Salinas negotiated the historical North American Free Trade Agreement. The establishment of NAFTA marked the first time two developed countries had invited a developing country into their trade bloc. Could this three-country trade bloc compete effectively against the much larger, newly-formed European Union? Would all three countries benefit from this arrangement?

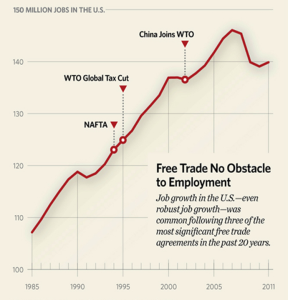

The doomsday scenario predicted by the opponents of free trade never occurred. For the U.S., the biggest fear was that Mexico would become a source of low-cost labor, leading to countless U.S. job losses (Chart 1).

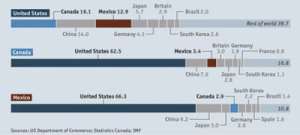

Although the worst-case scenario never occurred, neither did the windfall scenario. The establishment of this free trade zone did indeed foster some short-term growth, especially in the early years of adoption. Over the years, U.S. trade with Mexico increased by 506% compared to 279% with non-NAFTA countries.[1] In fact, in 2011, the U.S. traded as much with Canada and Mexico as it did with all the BRIC countries (Brazil, Russia, India, China), Japan, and South Korea combined![2]

The ability of Canada, the U.S., and Mexico to leverage the NAFTA is highly dependent on political and economically cyclical global factors. For instance, after the terrorist attacks of 9/11, the aggressive stance made by the U.S. to regulate borders made movement of goods slow to a crawl. The Mexico border continues to be a problem, slowing goods as they make their way through the supply chain. A few years later, China powered into the picture, joining the World Trade Organization (WTO) and offering even cheaper labor than Mexico. Instead of U.S. manufacturing jobs heading south, they went to Asia. Now, however, the equation is changing again as China’s labor costs have increased, reducing their competitive advantage.

So where do things stand now? There are several advantages that our North American economic bloc should seize. Looking ahead, there are industries NAFTA should integrate in order to once again get more “bang for our buck” out of the North American trading bloc.

Energy Cooperation

- Allow pipelines for expedient transportation of fuel.

- Privatize Mexico’s petroleum market. (in process)

- Allow Mexican trucks to transport across borders expeditiously.

Industry Cooperation

- Utilize the industrial capacity of the Mexican workforce to pursue labor-intensive projects. Labor costs in Mexico are now comparable to costs in China.

- Open new services to the free trade agreement: mobile phones, e-commerce, etc.

- Fix borders to make movement of goods and people more efficient.

After 20 years, we can safely say that the establishment of the NAFTA served to spur trade and make the North American continent more competitive (Chart 2). It has not been a smooth ride, however, but has been more cyclical in nature. From observation, it becomes clear that the most synergy comes from the initial reductions in tariffs and trade barriers. NAFTA allows the goods to move more freely and the careful management of the supply chain assigns each country tasks according to their comparative advantages.

A recent American University poll released in October showed that there remains widespread support among Canadians (80%), Mexicans (74%) and Americans (65%) for regional free trade.[3] Let’s do everything in our power to make our region an example of how free trade can flourish to benefit all countries involved!

[1] Ready to take off again? (2014, Jan 5). The Economist. http://www.economist.com/node/21592631/prin

[2] Deeper, Better, NAFTA. (2014, Jan. 5). The Economist. http://www.economist.com/node/21592612/print

[3] McLarty, T. (2013, Dec. 15). It’s time for NAFTA 2.0. The Wall Street Journal. http://online.wsj.com/news/articles/SB10001424052702303497804579240471443438530#printMode