As you may have noticed, there is a new sector in the S&P! The new sector designation was driven by changes to the Global Industry Classification Standard (GICS). These standards are developed and maintained by the Morgan Stanley Country Index (MSCI) and Standard & Poor’s Index (S&P). The goal of this classification system is to address the needs of the changing global marketplace. It was developed to be used worldwide. If you want to read more about the sector and industry breakdowns, a good research paper can be found at the following URL:

https://www.spcapitaliq.com/documents/products/GICS_Mapbook_v2.pdf

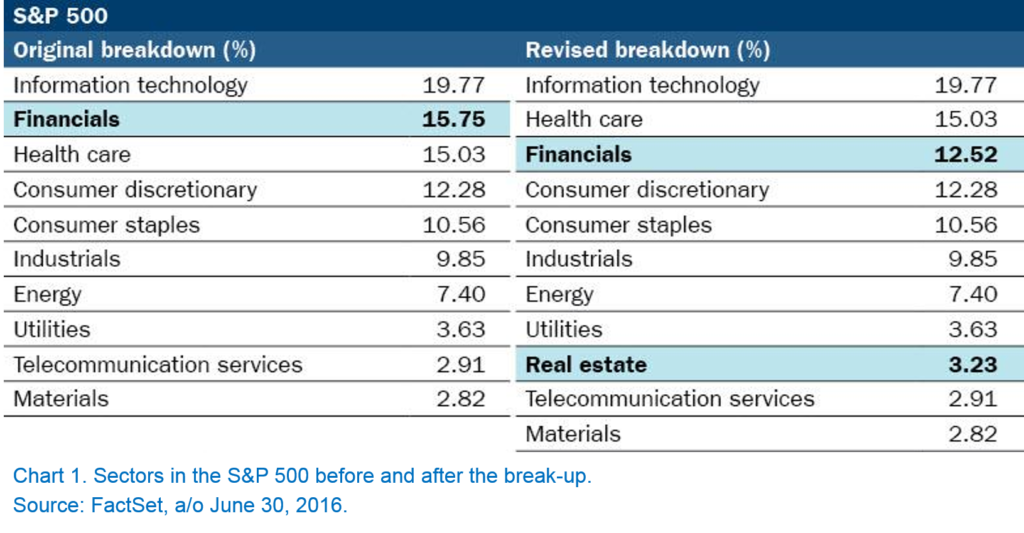

GICS started in 1997 with 10 sectors. September of 2016 marked the first sector change for the GICS with the addition of the 11th Sector – Real Estate. This is a group of securities that have been carved out of the Financial Sector to create their own space in the index (Chart 1).

So, why the new Real Estate sector? Investors have long viewed real estate investments as an asset class that is distinct from stocks and bonds. Although long-term returns on real estate rival those of stocks, the asset cycles are different. Real estate is considered a hard asset and is characterized by leverage, carrying costs (taxes and insurance), plus regional or country-specific policies. This new sector classification will enable investors to allocate directly to real estate without also owning the other financials (banks, thrifts and mortgage finance, financial services, consumer finance, capital markets, and insurance).

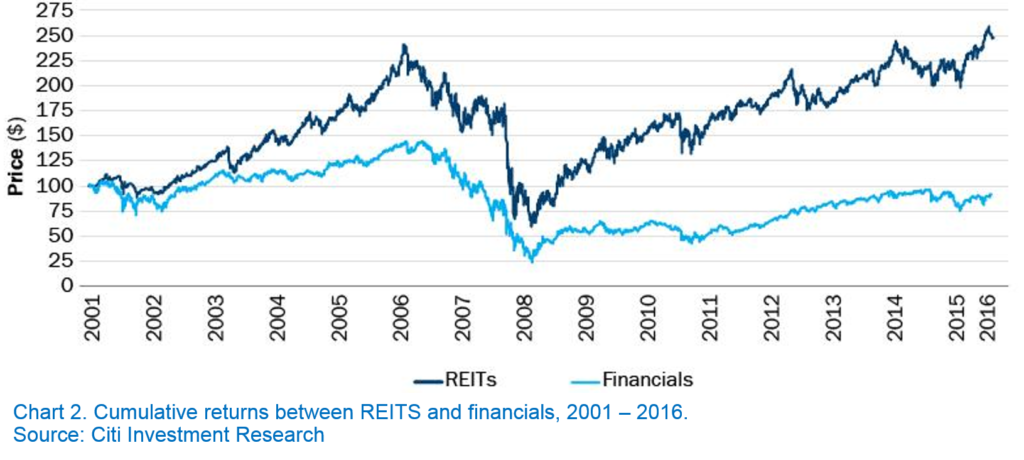

Perhaps the biggest driving force behind this change is the fact that, real estate investment trusts, or REITs, have dramatically outperformed other securities in the financial sector over the last cycle (Chart 2). Real estate investments are a way for investors to receive income as well as appreciation. The pull of mean reversion is strong, however, so those looking to move into this new sector should carefully consider whether the performance will continue in the short run (3 to 5 years). If rates start to rise, prices of real estate will likely recede.

In the long run, however, there is a strong case to be made for real estate investments (cycles of 20 years or more). The National Association of Home Builders (NAHB) estimates that the housing contribution to GDP averages between 15% and 18%. This includes about 3% to 5% residential construction and 12% to 13% consumption spending (rents and utilities).

In short, pay close attention to cycles and valuations and strongly consider real estate for a part of your personal or professional investment portfolio.