Sears, Roebuck & Company (Sears) was founded by Alvah Roebuck and Richard Sears in 1893. What started out as a catalog to sell watches and jewelry quickly grew into a business that offered hundreds of items for sale. Their competition? Local general stores. Rural customers were able to order from home out of a Sears catalog and have their goods delivered to them. In the industry, the dominance of the Sears catalog earned it the name “the Consumer Bible.” Sears postured itself as a store that provided everything a shopper could want. It even sold homes in its catalogs from the early to mid-1900’s (assembly required).

Sears’ initial public offering (IPO), under the ticker “S,” occurred in 1906, raising $40 million. It was a component of the Dow Jones Industrial Average from 1924 to 1999. During this time, Sears morphed itself from simply a catalog retail company into a bricks-and-mortar retailer, opening its first store in 1925. Early stores were often located in the suburbs in growing areas and featured hard goods like plumbing, tools, and car parts. In a few short years, Sears had more than 300 stores (see Chart 1). It also expanded its product lines to include merchandise the whole family would want. Store brands were successful, to name a few: Discover, Allstate, DieHard, Toughskins, Kenmore, Craftsman. Other retailers such as Montgomery Ward and Woolworth were also successful in early years, but Sears has outlasted them all. At its zenith, two-thirds of American consumers visited Sears at least quarterly and over half of all households had a Sears credit card. At one point, Sears comprised a full 1% of US GDP.[1]

Sears’ initial public offering (IPO), under the ticker “S,” occurred in 1906, raising $40 million. It was a component of the Dow Jones Industrial Average from 1924 to 1999. During this time, Sears morphed itself from simply a catalog retail company into a bricks-and-mortar retailer, opening its first store in 1925. Early stores were often located in the suburbs in growing areas and featured hard goods like plumbing, tools, and car parts. In a few short years, Sears had more than 300 stores (see Chart 1). It also expanded its product lines to include merchandise the whole family would want. Store brands were successful, to name a few: Discover, Allstate, DieHard, Toughskins, Kenmore, Craftsman. Other retailers such as Montgomery Ward and Woolworth were also successful in early years, but Sears has outlasted them all. At its zenith, two-thirds of American consumers visited Sears at least quarterly and over half of all households had a Sears credit card. At one point, Sears comprised a full 1% of US GDP.[1]

In the 70’s, the landscape began to change with the advent of Kmart, Walmart, Target, and strip malls. Customer foot traffic patterns began to shift and new habits began to form. Shoppers got into the habit of visiting several stores to get the prices/brands they liked most. In fact, by 2001, Walmart had already had five times more revenue than Sears.

Over time, Sears instituted many purchases and sales including the introduction of Discover credit cards, and the purchase of Coldwell Bank (real-estate broker) and Dean Witter (brokerage). Then, in 1993, Sears sold its catalog business as well as the supporting warehouses. Perhaps keeping these assets would have helped Sears make traction in online shopping.

After the 2005 merger of Kmart and Sears by hedge fund manager Eddie Lampert and ESL Investments, the stores became dilapidated as the focus shifted to cash generation and ways to get money out of the business. Sadly, since the merger, Sears Holdings (symbol: SHLD) has lost 96% of its market value, resulting in a bankruptcy declaration in October 2018.[2]

The advent of the internet has allowed consumers to comparison shop quickly and easily. It is imperative that retailers sell merchandise at reasonable prices. “Big box” retailers specialize in segments of the market and use technology to wring profits from a low-profit business: Walmart for price conscious, rural or small-town shopping; Costco for small business and bulk shopping; and The Home Depot for home improvement needs.

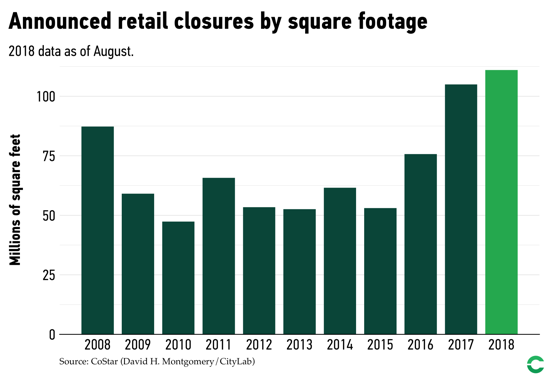

Investors fret about future obsolescence for retailers. It is prudent to consider the staying-power of retailers as consumer tastes and preferences change. Retail is indeed in peril, as the landscape continues to change (see Chart 2).

Let’s hope that Lampert and his ESL hedge fund can work a miracle and place a winning bid on Sears’ assets so that this icon will live to see another day.

Footnotes:

[1] Katz, Donald. The Big Store