Click here to download the PDF version of the newsletter.

In This Issue:

|

|

|

|

|

Investment Insights

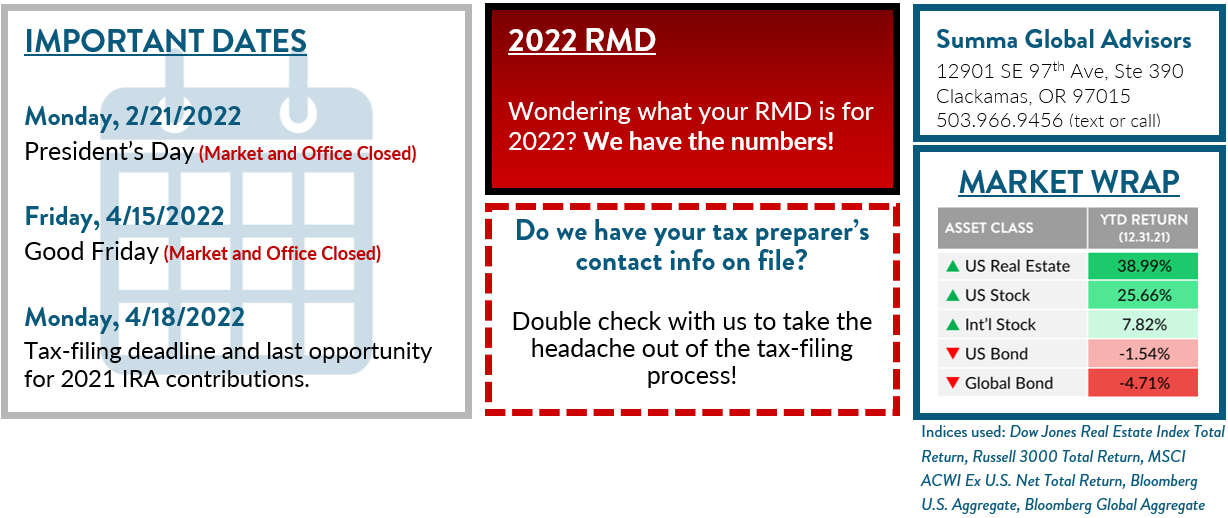

In 2021, the market showed strength, driven by a rebound in business and consumer spending. With the rebound came a spike in inflation created by persistent pandemic-induced supply chain problems, outsized demand, and rising wages.

2022 will be a challenging year, as the fight to control inflation takes center stage. U.S. investors have never navigated an economy marked by low rates and high inflation. The last time this phenomenon occurred was during the 1940s in the throes of World War II, and the world looked drastically different. To paint the picture, consider the following statistics from that decade*:

- U.S. was still on the gold standard, fixed at $35/ounce

- Oil had just been discovered in Saudi Arabia and cost $2.57/barrel

- The top personal tax rate was 91%

- Dividend yields averaged 5.7%

- Mutual funds were new and there were fewer than 100 of them

Today’s statistics can hardly compare to these facts and figures. The losers in our current environment will likely be businesses that cannot pass on price increases, consumers who must pay more for everyday items, and our older generation living on a fixed income.

At times like these, with inflation uncertainty, markets near all-time highs, and bond yields near all-time lows, it is important to remember the Proverb – the art is not in making money, but in keeping it.

*statistics are from the Morningstar Andex® chart

FAQs From Our Clients:

Are growth stocks the place to invest?

A handful of companies have achieved rapidly growing sales as well as earnings. However, in many cases, these companies have become so expensive that future returns may be lower than anticipated. Trimming (but not eliminating) these positions to purchase stocks that are trading at more reasonable valuations will reduce your downside risk.

Is the U.S. still leading the way?

U.S. stocks and businesses are still the gold standard in the world. Absent a policy error by the administration or Fed, the U.S. should retain its top spot. In dollar terms, international stock market indices have had a “lost decade” similar to what U.S. markets experienced from 2000-2010. The dividend yield and P/E valuations are much cheaper than the U.S. market. Making substantive allocations to overseas markets is a prudent way to diversify.

Plan Ahead

Gifting

⇑ Annual gift tax exclusion increases to $16,000 in 2022 (previously it was $15,000).

⇑ Non-citizen spouse annual limit increases to $164,000 in 2022 (previously it was $159,000).

Charitable

The $300 cash donation deduction available to those taking the standard deduction has expired.

Are you older than age 70½ and have an IRA? You’re able to make charitable gifts without it counting as taxable income. Contact us for more details.

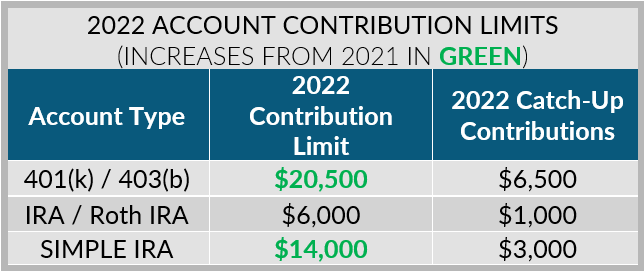

Retirement

Roth Conversions.

Volatile markets can provide opportunity to those who are prepared. Talk to us about strategic Roth conversions.

Were you born on or before 12/31/1950?

If you have an IRA, you are subject to required minimum distributions (RMD). Whether it’s your first year taking RMD or you’re already a pro, we’re here to help. We always take a proactive role in helping clients manage RMD effectively.

2022 Tax Tips

New Taxes?

Washington state passed a new capital gains tax in 2021. Click here for more details.

Updated Life Expectancy and Distribution tables go into effect in 2022.

The changes will affect account holders who have RMDs. Click here for a helpful tax guide resource (Summa is not affiliated with the content provider).

Summa Spotlight

In November, Rachel received the designation of Chartered Alternative Investment Analyst.

In November, Rachel received the designation of Chartered Alternative Investment Analyst.

Rachel continues to broaden her investment knowledge, which now includes a thorough understanding of real estate and other alternative investments. This knowledge will help us to best serve you, our clients, as the investing world evolves and new opportunities arise.