Forecasting and Confirmation Bias

As human beings, we cannot help but approach our investing with behavioral biases. Over the next few quarters, we will explore these biases in depth so that we can be careful to counteract them should they begin to affect our portfolios. This is a personal topic as well, since your investment managers can also suffer from behavioral biases if they are not held in check.

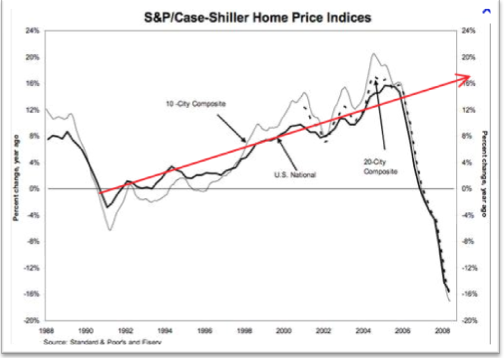

The first thing to understand is the difficulty of forecasting. For instance, most experts did not foresee the real estate market collapse (see graph below).

Even the most brilliant stock analysts fail to accurately predict future earnings for companies. As is often quoted, “Past performance is no guarantee of future results.” This is true. However, it is best if a forecast of the future includes an in-depth look at historical data and the formation of a trend line that could assist in the forecast. With this in mind, investors need to be aware that from January 1802 to June 2013, historical real returns for stocks have been 6.6% per year and bonds 3.5% per year.[1] Utilizing these numbers for determining present and future allocations and market expectations is a crucial exercise.

Even the most brilliant stock analysts fail to accurately predict future earnings for companies. As is often quoted, “Past performance is no guarantee of future results.” This is true. However, it is best if a forecast of the future includes an in-depth look at historical data and the formation of a trend line that could assist in the forecast. With this in mind, investors need to be aware that from January 1802 to June 2013, historical real returns for stocks have been 6.6% per year and bonds 3.5% per year.[1] Utilizing these numbers for determining present and future allocations and market expectations is a crucial exercise.

Another behavioral bias that often occurs is confirmation bias.

Our human tendency is to actively look for information that will support our beliefs. For instance, we will watch the news stations that most closely mirror our own beliefs. We may read books and newspapers in the same fashion.

Humans will often have strong opinions on subjects which are later discovered to be erroneous. As an example, if one believes the stock market will sell off, he/she will look for other “expert opinions” who are in agreement. The same is true if you are bullish. You can always find those who say “buy, buy, buy.”

It is best to combat this bias by

- Training yourself to research those viewpoints that contradict yours. There will be many valid arguments you need to consider.

- Seeking other people’s opinions. This is especially important for investors, since making partially-informed decisions or looking at only one side of the coin can be damaging to our portfolios.

- Not being afraid to challenge your own preferences and assumptions. This is particularly true when you take time to consider historical facts and figures.

- Weighing empirical evidence carefully. Performance of asset classes (stocks, bonds, real estate, commodities) is mean-reverting and assets trade in cycles—they will not always go up or always go down, so be careful not to get too optimistic or pessimistic. Remember that the market is a giant voting machine! Pay attention to how the market is treating certain stocks or asset classes in order to buy low and sell high.

Simply by using historical data to build forecasts and remembering to research all viewpoints before jumping into new ideas, we can help our investing become more robust and predictable. In the next quarters, we will explore more biases and how to combat them in order to become even better investors.

[1] Siegel, Jeremy. The Future for Investors. 2013 ed.