Tracking a Changing Marketplace

It’s a media feeding frenzy! Michael Lewis’ new book Flash Boys has created a stir among investors and regulators alike as they scramble to understand the ins and outs of high-frequency trading (HFT).

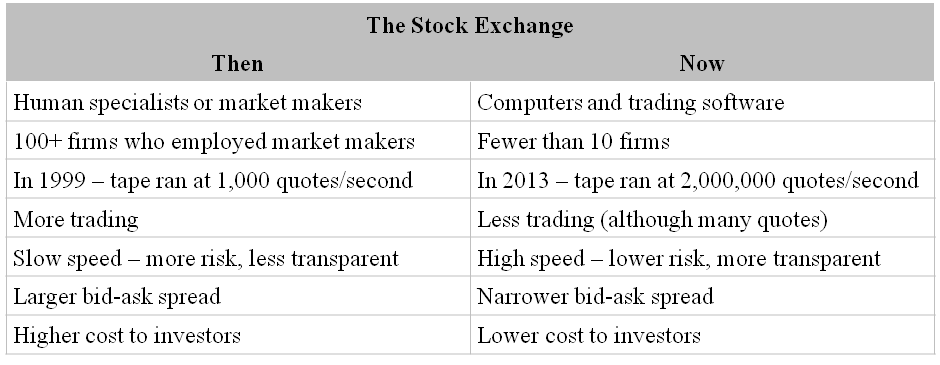

To make a long story short, HFT has been around for longer than 15 years. So, this is not a new phenomenon. High-frequency trading can be broadly defined as the use of computer algorithms to rapidly trade stocks.[1] Computers have replaced humans and have become the new trading specialists. The processing power of computers to match mathematical formulas with stock prices and immediately adjust to new information is mind-numbing. See the comparisons below to understand some of the major changes that have taken place in the last decade.

There are three types of strategies high frequency firms employ. Primarily, and most often, HFT firms are simply using arbitrage and dealing to enhance liquidity across markets. Secondarily, some HFT is structured to take advantage of news feeds and resulting changes in equity prices from fundamentals. Lastly, there are a handful of HFT firms whose strategy is to front-run other large proprietary traders (humans) or slower HFT traders. These are the firms who strive to obscure exactly what is happening with the trading situation so that they can make money on the fringes. These firms would likely be the ones under the greatest scrutiny by regulators as the regulators seek to “level the playing field.”There are positives and negatives about HFT. It is especially important not to put regulations into effect that might reduce the ease of trading, drying up market liquidity. That solution would be worse than the current problem.

There are three types of strategies high frequency firms employ. Primarily, and most often, HFT firms are simply using arbitrage and dealing to enhance liquidity across markets. Secondarily, some HFT is structured to take advantage of news feeds and resulting changes in equity prices from fundamentals. Lastly, there are a handful of HFT firms whose strategy is to front-run other large proprietary traders (humans) or slower HFT traders. These are the firms who strive to obscure exactly what is happening with the trading situation so that they can make money on the fringes. These firms would likely be the ones under the greatest scrutiny by regulators as the regulators seek to “level the playing field.”There are positives and negatives about HFT. It is especially important not to put regulations into effect that might reduce the ease of trading, drying up market liquidity. That solution would be worse than the current problem.

Generally speaking, the ability of computers to make trading cheaper and more efficient is the positive development for the market. Computers, when compared to humans, demonstrate the following superiorities. Computers

- have perfect attention spans,

- follow instructions exactly,

- do not allow emotion to cloud their judgment,

- can watch and learn from thousands of sources of information simultaneously,

- do not cheat, and

- cost less and require smaller offices.[2]

In the long run, however, it seems likely that only a couple of the fastest firms will survive this cutthroat business. This anti-competitive outcome could become a negative for the market, most likely driving transaction prices higher.

Another major drawback with computerized trading is that it can create and/or exacerbate systemic problems. An error in the algorithm(s) parameters used by any (or all) of the firms could cause a Flash Crash situation. If anyone with malicious intent were to obtain control of the order routing/generating system, they would be able to destabilize the market.

For the best of both worlds, the market needs to utilize both human and computer power. A balance of speed with safeguards should be utilized to provide the most efficient use of resources. The regulators must do their best to insure illegal behavior will not be obscured by all of the speed and activity in the market.

This discussion is merely the tip of the iceberg as the electronic market continues to evolve. The emotional debate about HFT rages on because people fear what they do not understand well. In spite of this, a market change that lowers costs and improves liquidity cannot be all bad!

[1] Forbes: High Frequency Trading: Is It a Dark Force Against Ordinary Human Traders and Investors? Sept. 30, 2013

[2] Harris, Larry. http://www.cfapubs.org What to Do about High Frequency Trading. March/April 2013 Pub.