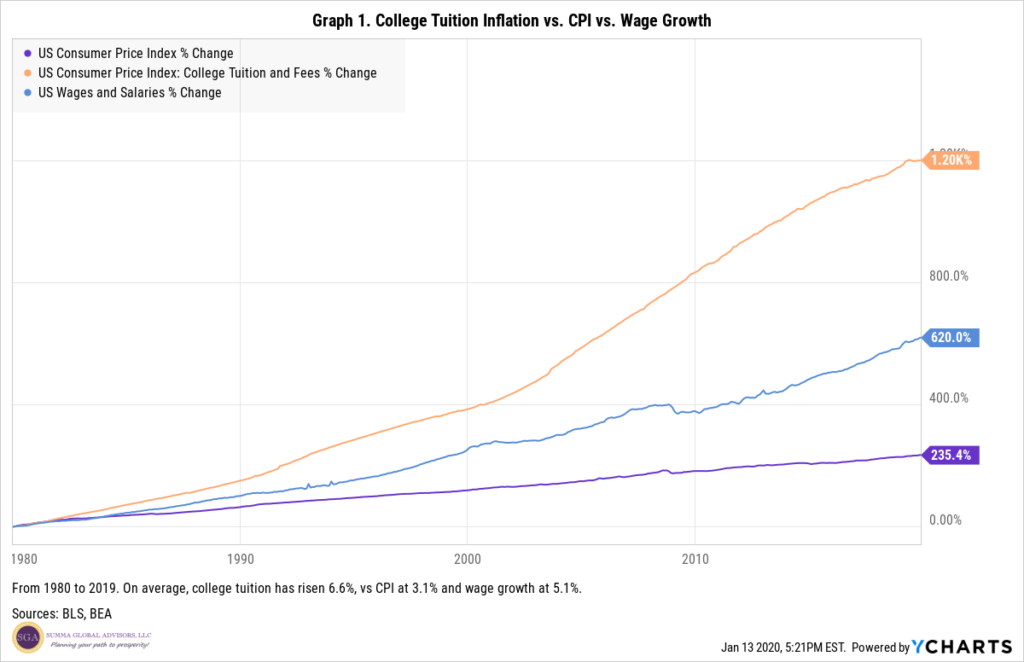

When it comes to saving for college, it feels like no matter what we do, the cost of tuition seems to be out of reach. As evident in Graph 1 below, over the past forty years, college tuition has risen more than twice as fast as the Consumer Price Index (CPI), averaging about 6.6%, compared to CPI’s 3.1% and wages and salaries’ 5.1% annualized growth.

During the 1980s, several states began contemplating the idea of a program where residents could prepay for college tuition, and Florida and Wyoming actually brought that idea to life! After realizing the need for a concerted effort, Congress, in 1996, introduced and passed the Small Business Protection Act, which led to the creation of 529 College Savings Plans (529 Plans). But it wasn’t until 2001 that the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) made 529 Plan distributions for qualified college expenses tax free. Recent legislation has further expanded the use of 529 Plans to include K-12 education as well as student loan repayment.

Because each state, plus District of Columbia, sponsors its own 529 Plans and many states offer multiple options, there are close to 100 plans to choose from. This makes it very difficult and confusing for the consumer (mostly parents and grandparents) to navigate the landscape and conduct research. The following information can serve as a starting point to help answer questions and narrow down the choices.

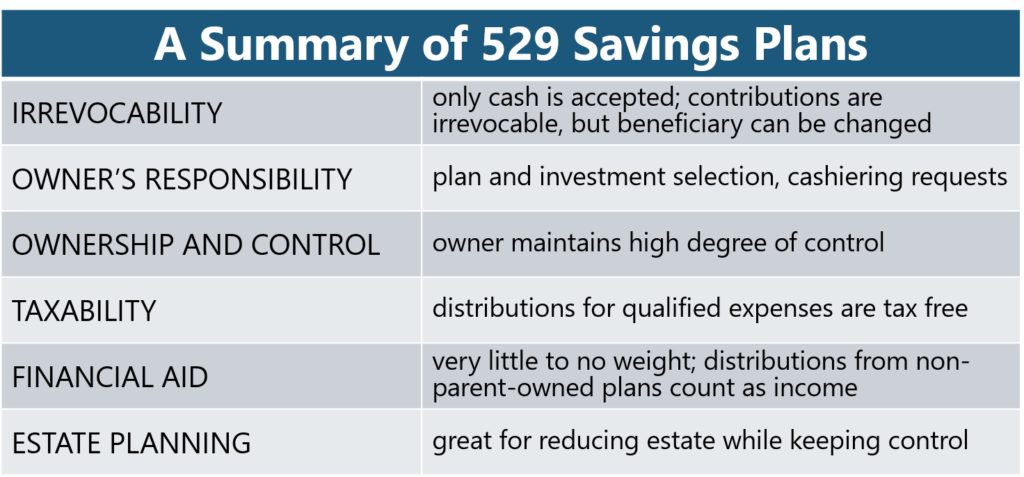

- Irrevocability: While contributions made into a 529 Plan can rarely be reversed, the plan owner can change the beneficiary, for instance, to another child or a niece or nephew. However, if the plan is funded with money previously held in a minor-controlled account (custodial or education-savings account), then the beneficiary cannot be changed. Much like an IRA, the only form of accepted contribution is cash.

- Owner’s Responsibility: As an owner of a 529 Plan, your responsibilities include choosing the right plan for the minor, determining a savings goal, selecting a suitable investment allocation, monitoring investment performance, and submitting distribution requests. There are usually very few tax reporting requirements.

- Ownership and Control: 529 Plan owners retain unique control such as changing the beneficiary to another family member, as stated above. Minor beneficiaries usually do not assume control or ownership when they reach age of majority. Owners can also change plan investments no more than twice a year.

- Taxability: Taxability of 529 Plans can be broken down into two main categories: contributions and distributions.

- Contributions: Because contributions to a 529 Plan are made from after-tax funds, there are no federal income-tax deductions. However, many states (like Oregon) offer state income tax deductions or credits for contributions to their respective state-sponsored plan (for a complete list, check out How much is your state’s 529 plan tax deduction really worth?). 529 Plans are also the only vehicle that allows a taxpayer to “frontload” five years’ worth of annual gift-tax exclusion amount in one year. For example, a grandparent could make a lump-sum contribution to a 529 Plan of up to $75,000 ($150,000 for a couple) without incurring gift taxes in 2020.

- Distributions: The biggest advantage of 529 Plans is that distributions for qualified expenses are completely tax-free. What are qualified expenses? College tuition and fees, books and supplies, room and board are qualified, while college application and testing fees, transportation costs, and health insurance are not. For more information, refer to these two articles: What you can pay for with a 529 plan and What you can’t pay for with a 529 plan. If a child gets a scholarship, only the earnings portion of the money taken out to offset the scholarship will be subject to ordinary income tax.

- Financial Aid: If a 529 Plan is owned by a parent or the beneficiary, then only up to 5.6% of the plan assets are included in the expected family contribution (EFC) on the FAFSA. That, compared with a 20% EFC weight on custodial assets, is another major advantage. However, if a 529 Plan is owned by a non-family member, say a grandparent, while the plan assets have no impact on a student’s EFC, distributions will be counted as income for the beneficiary, negatively affecting the eligibility for need-based aid the following year. A strategy to alleviate that is to make distributions from a non-parent-owned plan during the final two years of college.

- Estate Planning: If the goal is to benefit a child or grandchild, reduce taxable estate, and still maintain certain control over the assets, look no further than a 529 Plan. Because of its unique lump-sum contribution provision, a couple can put as much as $150,000 into a 529 Plan without using their lifetime gift tax exemption. However, if a taxpayer dies before the 5-year window is up, a prorated portion of the gift will be included in his or her taxable estate. In the event of a beneficiary’s death, the value of the plan is included in the beneficiary’s estate and the owner can either name another beneficiary or withdraw the assets without penalty.

As 529 Plans continue to gain popularity and plan assets top $200 billion, we can expect more parents and grandparents to favor these vehicles as the primary choice for college savings. Let us know if this resonates with your situation. We are here to help!

As 529 Plans continue to gain popularity and plan assets top $200 billion, we can expect more parents and grandparents to favor these vehicles as the primary choice for college savings. Let us know if this resonates with your situation. We are here to help!