In previous piggy bank series articles, we touched on the two most common savings vehicles for education needs – custodial accounts and 529 college savings plans. While both of them offer simplicity, low costs, and valuable tax savings, they lack the flexibility desired by certain families. For example, parents may prefer their child to have the assets at a later age than many state laws dictate in a custodial format. Some grandparents like to help their grandchildren through life insurance as a bequeath. For those who desire a high degree of flexibility, an education trust may fit the bill.

If custodial accounts and 529 plans were a casual-dining restaurant where the consumer experience was straight-forward and inexpensive, an education trust would be comparable to a high-end steak house where the personal dining experience and attention to detail are available, albeit at a higher cost.

Trusts are legal contracts with specific instructions on how the trustee should carry out the contract terms for the benefit of the trust beneficiaries. Because of this, there is a very high degree of customization allowed by federal and state laws.

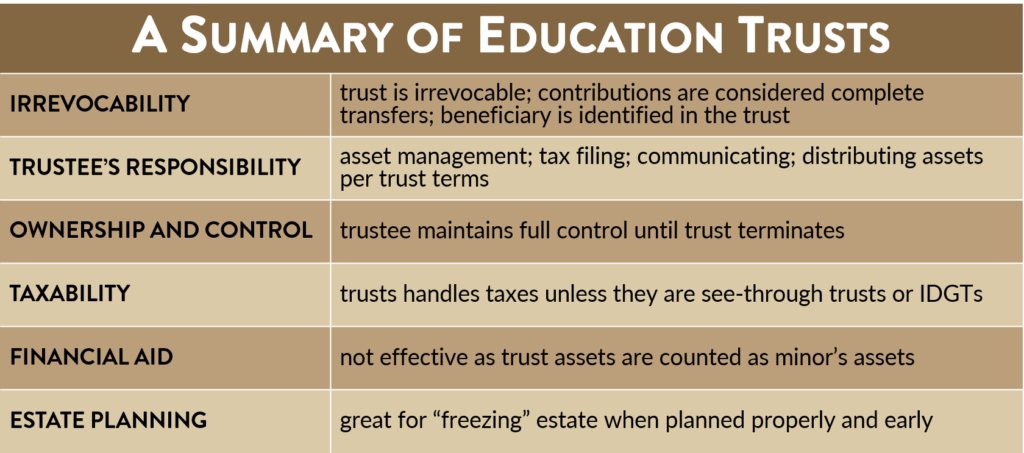

Now for some specifics on education trusts (some may be a bit “technical” and boring):

- Irrevocability: Education trusts are a type of irrevocable trust, meaning that once it is created and funded by the grantor (benefactor), the transfer is considered a completed gift and cannot be reversed. These trusts usually terminate (unwind) upon the beneficiary reaching certain milestones such as attaining a college degree or reaching a certain age. Unlike other instruments previously discussed, education trusts can hold various assets: stocks, bonds, real property, and even life insurance.

- Trustee’s Responsibility: Because a trust is a legal contract, the trustee is bound by its terms when managing the trust assets and carrying out its provisions. These include, but are not limited to, investing the assets prudently (i.e. diversification), distributing funds to beneficiaries on permitted expenses (i.e. education), and filing tax returns. Should the current trustee no longer be willing or capable of serving, an alternate trustee will take on the role. For complex trusts with stringent or extraordinary requirements, a corporate or professional trustee is highly recommended.

- Ownership and Control: No one actually owns the assets in an education trust – not the grantor, not the trustee, and certainly not the beneficiary until the trust terminates. However, the trustee retains full control through the power provided by the trust instrument, which must answer several fundamental questions:

- What is the purpose of the trust?

- Who is responsible for carrying out the trust purpose?

- Who is the beneficiary or beneficiaries?

- When and under what circumstances can funds be disbursed, and how much?

- When and how to unwind (terminate) the trust?

- Taxability: Many families, particularly wealthy grandparents, choose to set up education trusts to reduce their estate taxes.

- For example, if Grandma Betty owns a $2 million life insurance policy, that amount is part of her estate when she passes away. Instead of that outright ownership arrangement, Betty sets up an education trust and transfers the life insurance to the trust. That $2 million will not be counted and avoid applicable estate tax after meeting certain requirements.

- Many education trusts are set up as accumulation trust, i.e. no mandatory annual distribution of net investment income. Thanks to that, the trusts are responsible for the taxable income generated within. Top marginal rate (37%) applies when taxable income is over $12,950 for 2020, so an

investment allocation that minimizes taxable income is often an important consideration. - Trusts incurring significant taxable income can be set up in a way that income tax liability falls back on the trustor, using a technique known as intentionally defective grantor trusts (IDGTs).1 These are effective when a trust is primarily comprised of income-generating assets such as rental properties.

- Contributions: There is not a rule-of-thumb or appropriate initial amount to fund an education trust. It should be a product of collaborative effort between family members involved, your attorney, CPA, investment adviser and even insurance agent if necessary. Ongoing contributions are also permitted, subject to annual gift-tax exclusion amount and the Crummey powers2 to ensure the contributions are in compliance with various tax rules.

- Distributions: Distributions from an education trusts are straight-forward since the trust clearly outlines what constitutes allowable expenses. In addition to education expenses, some trusts may also include support clauses for essentials such as healthcare and housing. However, the allowable expenses will be limited, as education trusts are designed to protect against irresponsible spending and frivolous creditor claims.

- Financial Aid: Under most circumstances, education trust assets are counted as the beneficiary’s (student’s) assets, just like a custodial account. Furthermore, the net present value of the trust principal is considered even if the beneficiary will not receive the assets until sometime in the future.3 In short, education trusts are not an effective tool when it comes to financial aid, but the families establishing these trusts are not typically eligible for financial aid.

- Estate Planning: While ineffective in other areas, education trusts are an exceptional tool in estate planning, especially in freezing estate value. As our Grandma Betty example shows, she is able to reduce her estate by funding an education trust with a $2 million insurance policy.

- Consider another scenario: Uncle Joe, who has no children of his own, decides to fund an education trust for the benefit of his newborn niece, Jackie. Joe transfers $100,000 into the trust and invests in a diversified portfolio. Assuming a 6% annual growth rate, the trust will have accumulated over $285,000 by the time Jackie turns 18. None of that is included in Uncle Joe’s estate. This is particularly important for residents domiciled in states with high estate or inheritance taxes, like Oregon and Washington.

As you can see, education trusts are more involved and specific than a typical college planning mechanism. Most families will be served best by utilizing a 529 Plan or through careful financial-aid planning. However, when used fittingly, education trusts offer powerful solutions and tremendous flexibility.

As you can see, education trusts are more involved and specific than a typical college planning mechanism. Most families will be served best by utilizing a 529 Plan or through careful financial-aid planning. However, when used fittingly, education trusts offer powerful solutions and tremendous flexibility.

Keep an eye out for a comparison of all three account types from the Piggy Bank Series, which will soon be added to the toolbox on our website.

Footnotes:

1. https://blog.commonwealth.com/estate-planning-with-intentionally-defective-grantor-trusts

2. https://www.stimmel-law.com/en/articles/crummey-powers-avoiding-gifts-tax

3. https://www.finaid.org/savings/trustfunds.phtml