“The Amazon Effect.” This phrase has come to mean the upending of retail as we know it. Slowly, but surely, buyers’ habits are changing. Consider this list of names: Radio Shack, Payless, Gymboree, The Limited. All of these well-known stores, and 19 others, have been added to the pile of 2017 retail bankruptcies. What exactly is happening underneath the surface to cause such disruption?

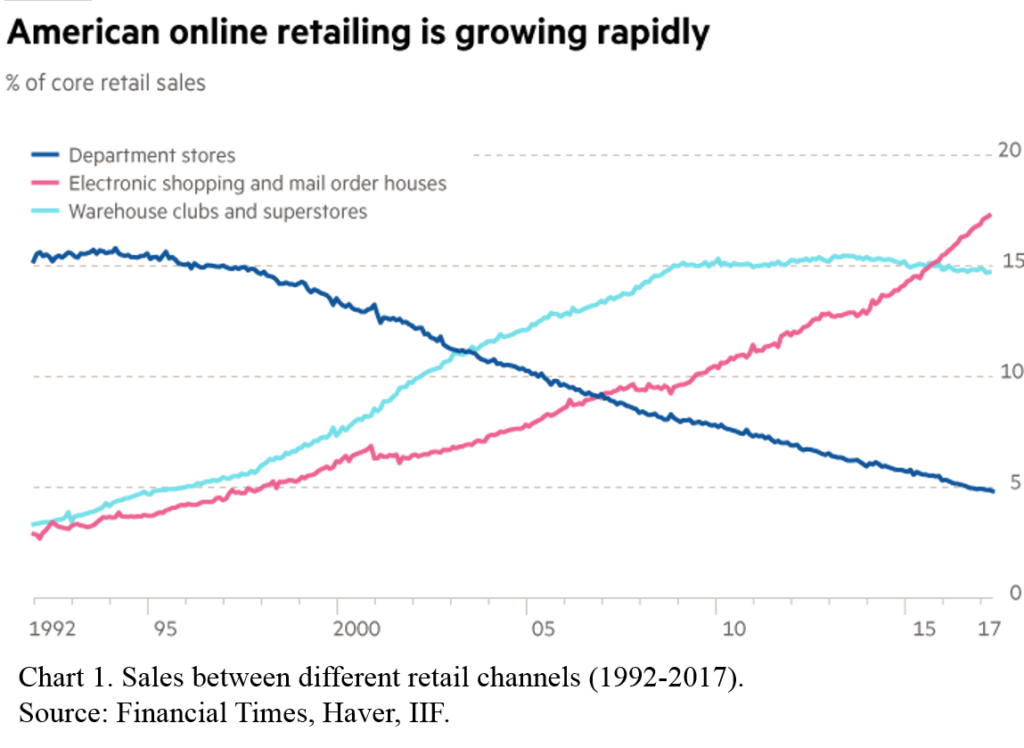

OVERBUILDING. The real estate boom in the early 2000’s resulted in an ensuing retail boom. Cheap financing and strong consumer spending trends as a result of home equity access created demand that was unsustainable. At the same time that the credit crunch hit, the use of smart phones and the availability of online shopping began to change consumer spending habits (Chart 1).

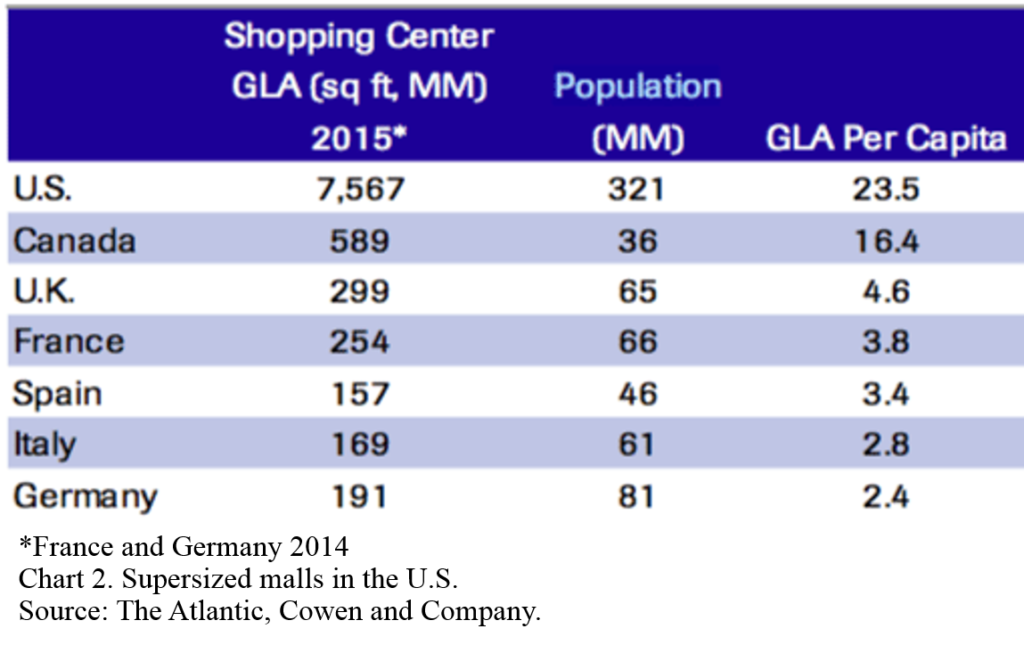

The dual forces of additional square footage and the ecommerce availability combined to create an excess that will need to be addressed. The U.S. economy, as compared to other countries, had built many more malls than the consumers could support, as measured by per capita gross leasable area, or GLA (Chart 2).

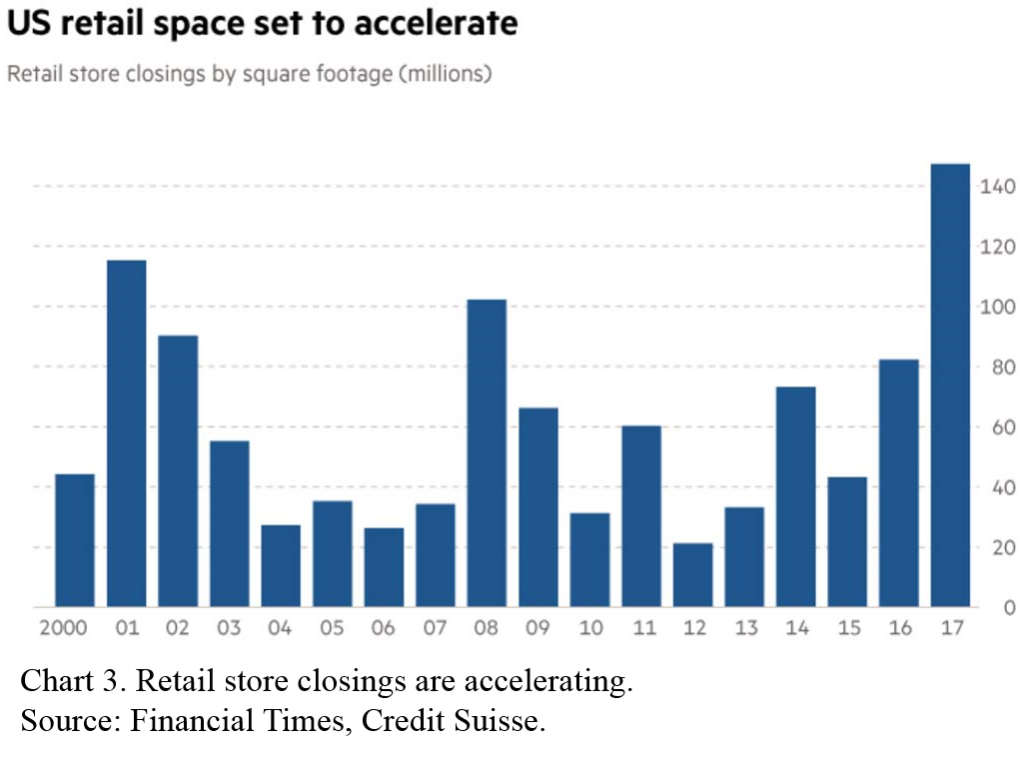

Credit Suisse estimates that as many as 8,640 stores with 147 million square feet of retailing space could close down this year (Chart 3). As a result, many jobs will be lost. Just this year, the retail industry has lost approximately 9,000 jobs per month, compared with gains of 17,000 per month in 2016, according to the Bureau of Labor Statistics.

OVERLEVERAGING. Retailers who were heavily indebted going into the 2007 real estate downturn are struggling to keep their stores afloat. Over the past ten years, ecommerce has taken a big bite out of foot traffic and profits, causing the S&P ratings agency to downgrade 20% of retailers to junk status. Delinquencies and bankruptcies are picking up speed as repeated restructurings fail to bring consumers back into the stores, with Toys R Us being the latest big name to fall victim to the changing retail landscape. In fact, so far this year, bankrupt storefronts hold combined liabilities of over $5 billion on their books. The retail sector of the S&P is currently the most distressed sector in the market and the ratings agency has noted warnings such as “difficulty adapting to online retail” or “shifting consumer tastes” as structural causes for concern.

OVERLEVERAGING. Retailers who were heavily indebted going into the 2007 real estate downturn are struggling to keep their stores afloat. Over the past ten years, ecommerce has taken a big bite out of foot traffic and profits, causing the S&P ratings agency to downgrade 20% of retailers to junk status. Delinquencies and bankruptcies are picking up speed as repeated restructurings fail to bring consumers back into the stores, with Toys R Us being the latest big name to fall victim to the changing retail landscape. In fact, so far this year, bankrupt storefronts hold combined liabilities of over $5 billion on their books. The retail sector of the S&P is currently the most distressed sector in the market and the ratings agency has noted warnings such as “difficulty adapting to online retail” or “shifting consumer tastes” as structural causes for concern.

It is difficult to forecast the long-term outlook for consumer purchases and retailing. Suffice it to say that technology has changed the landscape permanently by giving customers a seemingly endless number of choices. How exciting to see retail history unfold right in front of our eyes!