Back in 2011, I wrote a piece on how human brains start to lose analytical skills as we age and how an independent advisor can help protect seniors from financial frauds.[1] A short time has passed, I have gotten a few more wrinkles and furrows, and it is a good time to review this subject again.

According to the Alzheimer’s Association, there are over 5.3 million Americans diagnosed with the disease, nearly two-thirds of them are women, but only a third of all patients are aware that they carry it.[2] For Oregon and Washington, the number of people with Alzheimer’s is projected to increase to 220,000 by 2025.

People suffering from diminished capacity (DC), or cognitive impairment, require increasing assistance and grow dependent on others: family members, friends, caregivers, doctors, and even neighbors. Aging is certainly a cause of DC, but other risk factors have been linked to DC, including a certain strand of gene (APOE-e4), family history of Alzheimer’s, mild cognitive impairment (MCI), and cardiovascular disease. Additionally, there are external factors contributing to the manifestation of dementia, such as the level of education, social engagement and brain injury.[3]

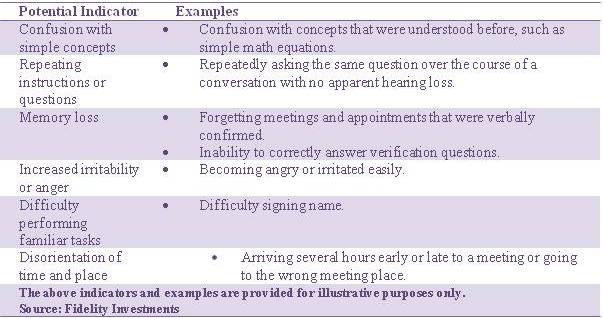

What are the common signs or potential indicators of diminished capacity? The following table provides a good illustration.

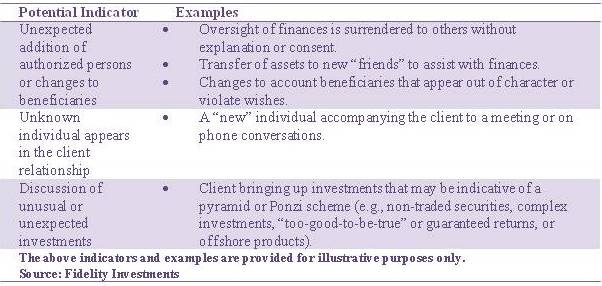

Situations that could come across our interaction with clients and indicate possible financial abuse or frauds are listed below:

Of course we are by no means qualified or experts in determining whether someone is suffering from diminished capacity or dementia. However, often having a long-term relationship with our clients, we are one of the first people who may recognize symptoms of potential DC issues, as the above examples illustrate. Our firm and people also have the resources and knowledge to prepare ourselves and clients for this situation, should it become a reality. Rick Fleming, an SEC Investor Advocate, believes the country’s changing socio-economic trend, i.e. the “shift from defined benefit retirement plans…to defined contribution plans, where…the Baby Boomer generation will exercise far greater control over their retirement assets than preceding generations,” is another reason, coupled with DC, behind the proliferation of financial exploitations.[4]

On a relationship note, we know our clients and their unique situations, from their investing profile, cash flow and spending patterns, to family dynamics. If something out of the ordinary takes place, such as erratic account activity, it would catch our attention and we could alert the client about unusual patterns.. We also encourage elderly clients to engage at least one other family member or a trusted individual either as a stand-by or delegate legal powers—through powers of attorney or assigning successor/co-trustee role—over their assets. That way we can continue serving the client’s needs and keep the dialog open with those “backup” individuals. Having family meetings, sometimes with attorney and CPA present, is another excellent way to lay the groundwork for dealing with diminishing capacity. Between these professionals, we can cover most aspects of a client’s life, although it is also prudent to include a primary physician when needed.

Internally, our staff is trained to diligently record all client-related communications, meetings, and other requests in detail, using robust client-relationship-management software. Furthermore, we work very closely with our custodians who provide education materials and resources to both advisors and clients on how to handle situations involving diminished capacity.

Ultimately, we respect your ability to make sound, independent decisions. Planning for your future includes forethought about how best to serve you through good and bad times. We would be happy to sit down and discuss your situation specifically if you wish. Do not hesitate to contact us for more information or to set up a meeting.